Accounting, Tax and Financial Services

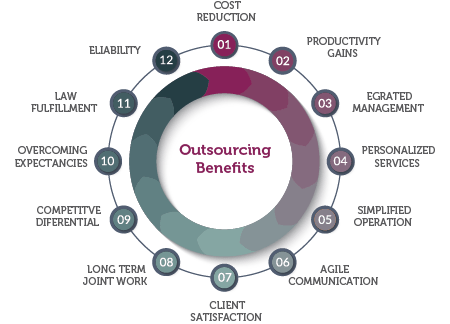

By outsourcing ancillary activities, executed through structured processing and procedures, we optimize the productivity of our clients’ internal processes, so they may concentrate their efforts on their core business.

Accounting, Tax and Financial Services

By outsourcing ancillary activities, executed through structured processing and procedures, we optimize the productivity of our clients’ internal processes, so they may concentrate their efforts on their core business.

Accounting Services

- Analysis and classification of accounting records;

- Preparation of financial statements;

- Reconciliation of ledger accounts;

- Preparation and online delivery of Digital Accounting Bookkeeping (DAB);

- Preparation of USGAAP x BRGAAP comparative reports;

- Auditing support.

Tax Services

-

Monthly calculation of direct and indirect taxes required according to the business purpose and client transactions;

- Monthly calculation of taxes and withholding contributions on services purchase;

- Filing and online delivery of ancillary tax obligations;

- Analysis and recording of incoming and outgoing tax invoices;

- Support to audits and inspections.

Payroll Advisory

-

Payroll calculation and processing;

- Issuance of payroll receipts;

- Review of payroll calculation;

- Calculation of social security and labor charges levied on payroll;

- Preparation of documentation related to the admission of new employees;

- Preparation and delivery of payroll-related ancillary obligations, including eSocial.

Financial Advisory

-

Execution of Treasury routines;

- Processing of Accounts Payable (AP) and Accounts Receivable (AR);

- Financial reconciliation involving the closing of payables and receivables;

- Preparation of aging lists.

Online access to

PAYMENT RECEIPTS

of your company

PLBrasil Accounting&Finance customers and their employees now have online access to payment receipts. This is the first module of the New Portal that will go live. Soon, we will launch other features that will give access to payroll, receipt of payment guides, invoices, slips and other accounting and tax documents, as well as opening new requests and receiving communications.

Another facility we offer our customers!

Accounting

Services

- Analysis and classification of accounting records;

- Preparation of financial statements;

- Reconciliation of ledger accounts;

- Preparation and online delivery of Digital Accounting Bookkeeping (DAB);

- Preparation of USGAAP x BRGAAP comparative reports;

- Auditing support.

Accounting

Services

-

Monthly calculation of direct and indirect taxes required according to the business purpose and client transactions;

- Monthly calculation of taxes and withholding contributions on services purchase;

- Filing and online delivery of ancillary tax obligations;

- Analysis and recording of incoming and outgoing tax invoices;

- Support to audits and inspections.

Accounting

Advisory

.

-

Payroll calculation and processing;

- Issuance of payroll receipts;

- Review of payroll calculation;

- Calculation of social security and labor charges levied on payroll;

- Preparation of documentation related to the admission of new employees;

- Preparation and delivery of payroll-related ancillary obligations, including eSocial.

Accounting

Advisory

-

Execution of Treasury routines;

- Processing of Accounts Payable (AP) and Accounts Receivable (AR);

- Financial reconciliation involving the closing of payables and receivables;

- Preparation of aging lists.

Recovery of unduly paid taxes

According to data from the Brazilian Institute of Geography and Statistics (IBGE/Taxmeter), 95% of the companies pay undue taxes because the Brazilian tax legislation is deemed one of the most complex legislations worldwide. There are several taxes that may be recovered. Bring your company to PLBrasil Accounting&Finance to always have your taxes up to date and recover unduly paid taxes.

Financial Consulting

We offer solutions to support your business in structuring, monitoring and managing financial and accounting information, adjusting our services according to each company’s needs, regardless of their size or segment.

Hire the accounting consulting of PLBrasil Accounting&Finance to analyze whether there are control faults, frauds or irregularities in your business management.

Access your company’sPAYMENT

AND VACATION

RECEIPT

online

PLBrasil Accounting&Finance customers and their employees now have online access to payment receipts. This is the first module of the New Portal that will go live. Soon, we will launch other features that will give access to payroll, receipt of payment guides, invoices, slips and other accounting and tax documents, as well as opening new requests and receiving communications.

Another facility we offer our customers!

Recovery of unduly paid taxes

According to data from the Brazilian Institute of Geography and Statistics (IBGE/Taxmeter), 95% of the companies pay undue taxes because the Brazilian tax legislation is deemed one of the most complex legislations worldwide. There are several taxes that may be recovered. Bring your company to PLBrasil Accounting&Finance to always have your taxes up to date and recover unduly paid taxes.

Financial Consulting

We offer solutions to support your business in structuring, monitoring and managing financial and accounting information, adjusting our services according to each company’s needs, regardless of their size or segment.

Hire the accounting consulting of PLBrasil Accounting&Finance to analyze whether there are control faults, frauds or irregularities in your business management.

OTHER SERVICES

Get to know all solutions for your business.

Balance Sheets

We demonstrate the accounting, financial and economic position of your company.

Reconciliations

Reconciliation of ledger accounts to verify and validate the balance composition.

Treasury

We administer the financial transactions of your business.

Accounts Payable

We manage the registries of financial outflows of the company.

Accounts Receivable

We follow-up the registries of financial inflows of the company.

Human Resources Benefits

We manage all Human Resources benefits of your business.

Accounting Reports

We follow the International Accounting Rules, as well as the BR GAAP and the US GAAP.

Ancillary Obligations

Always be up to date with the Tax and Accounting Ancillary Obligations required by legislation.

Balance Sheets

We demonstrate the accounting, financial and economic position of your company.

Reconciliations

Reconciliation of ledger accounts to verify and validate the balance composition.

Treasury

We administer the financial transactions of your business.

Accounts Payable

We manage the registries of financial outflows of the company.

Accounts Receivable

We follow-up the registries of financial inflows of the company.

Human Resources Benefits

We manage all Human Resources benefits of your business.

Accounting Reports

We follow the International Accounting Rules, as well as the BR GAAP and the US GAAP.

Ancillary Obligations

Always be up to date with the Tax and Accounting Ancillary Obligations required by legislation.

Tailor-made solutions to boost your company’s growth

Imagine reducing costs, optimizing processes and having more time to focus on what really matters: growing your business. At Grupo PLBrasil, we dive into your project, understand your moment and create tailor-made solutions to boost your growth.

Find out how we can optimize your processes, reduce costs and unleash your company’s full potential. Request your personalized proposal now.

Tailor-made solutions to boost your company’s growth

Imagine reducing costs, optimizing processes and having more time to focus on what really matters: growing your business. At Grupo PLBrasil, we dive into your project, understand your moment and create tailor-made solutions to boost your growth.

Find out how we can optimize your processes, reduce costs and unleash your company’s full potential. Request your personalized proposal now.

Get to know all solutions for your business.

Fiscal Calendar

Stay on top of the most important dates of the 2025 Tax Calendar, avoiding fines and fees.

Sign up below to receive the 2025 Tax Calendar free of charge in your email.

You can unsubscribe at any time by clicking on the link on the footer of our emails. For further information, read our policies.

We use the E-goi platform. By subscribing, , you consent to your data being processed by this platform. To learn about E-goi’s policies, click here.

Fiscal Calendar

Stay on top of the most important dates of the

2025 Tax Calendar, avoiding fines and fees.

Sign up below to receive for free

the 2025 Tax Calendar in your email.

You can unsubscribe at any time by clicking on the link on the footer of our emails. For further information, read our policies.

We use the E-goi platform. By subscribing, , you consent to your data being processed by this platform. To learn about E-goi’s policies, click here.

ACCOUNTING ARTICLES

ISS in the Municipality of São Paulo: tax benefits for single-profession companies

The municipal law 17.719/21 brought important changes to the classification of so-called single-profession companies (SUP), defined as those where the professionals (partners, employees or not) are qualified to exercise the same activity and provide [...]

What does DEFIS show?

published on 03/16/2023 by Melissa Scarpelli This is a tax obligation with a deadline of March 31, 2023. The purpose is to prove that taxes due have been [...]

RAIS 2023: Deadline for 4Group

published on 03/15/2023 by Camila Palmeira The deadline for Group 4 (public bodies and international organizations) to submit the RAIS 2023 (base year 2022) is April 05, 2023. [...]

ACCOUNTING ARTICLES

ISS in the Municipality of São Paulo: tax benefits for single-profession companies

The municipal law 17.719/21 brought important changes to the classification of so-called single-profession companies (SUP), defined as those where the professionals (partners, employees or not) are qualified to exercise the same activity and provide [...]

What does DEFIS show?

published on 03/16/2023 by Melissa Scarpelli This is a tax obligation with a deadline of March 31, 2023. The purpose is to prove that taxes due have been [...]

RAIS 2023: Deadline for 4Group

published on 03/15/2023 by Camila Palmeira The deadline for Group 4 (public bodies and international organizations) to submit the RAIS 2023 (base year 2022) is April 05, 2023. [...]